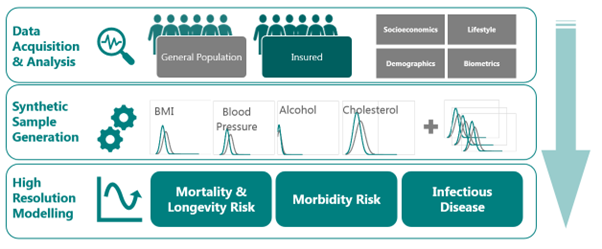

Our Portfolio Data Enrichment Service is a cutting-edge solution designed to augment and enhance your life & pensions portfolio data. By leveraging advanced techniques such as synthetic sample generation based on Spearman Rank Correlation and Cholesky decomposition, we create a robust sample portfolio that accurately reflects the characteristics of a target insurance or pension portfolio. We leverage demographic and socioeconomic data to estimate biomedical risk factors such as BMI, blood pressure and smoking.

This enriched data provides our clients with a powerful tool to improve risk assessment, pricing strategies, and predictive modelling. By combining this synthetic sample data with our in-house disease specific modelling tools, insurers can gain deep insights into mortality and morbidity risks, model the impact of various interventions on clinical outcomes like mortality, and offer more personalized and tailored insurance coverage to their customers. Insurers can also use this technique to validate new product outcomes across various population biomedical risk profiles.

With our Portfolio Data Enrichment Service, insurers can enhance their data-driven decision-making, stay competitive in the market, and ultimately deliver better products and services to their policyholders.